Equity analysis is a crucial process that enables investors to make wise decisions in the dynamic world of stock markets. With numerous opportunities and risks at every turn, understanding the fundamentals of equity analysis becomes essential. It is not just about analyzing numbers; it involves a blend of creativity and science, where analytical skills meet market intuition. This duality allows investors to navigate the complexities of various financial instruments and spot stocks that are poised for growth.

In an ever-evolving market landscape, leveraging the expertise of equity analysis specialists can provide a significant advantage. These experts utilize a range of methodologies to assess a company’s financial health, competitive positioning, and growth potential. By merging quantitative metrics with qualitative insights, they offer a well-rounded perspective that can guide investment strategies. Whether you are a seasoned investor or just starting out, understanding the nuances of equity analysis can improve your ability to make wise financial decisions and ultimately achieve your investment goals.

Understanding Equity Analysis

Equity analysis is a crucial method that consists of assessing a business’s monetary health, expansion capability, and total value to create wise investment decisions. Investors strive to identify the intrinsic valuation of a stock by reviewing various financial measures, firm news, industry trends, and economic environments. By evaluating these components, stakeholders can spot undervalued or overpriced stocks, shaping their buying or divestment strategies.

One key element of equity analysis is the examination of financial statements, which include the balance sheet, income statement, and cash flow statement. These documents provide understanding into a business’s revenue, expenses, profits, and debt levels. Professionals in equity analysis leverage these statements to determine important ratios such as earnings per share, return on equity, and price-to-earnings ratio, assisting investors evaluate a company's results in relation to its competitors.

In alongside numerical analysis, qualitative elements also play a significant role in equity analysis. This includes comprehending the company's management team, market standing, competitive advantages, and potential hazards. A comprehensive strategy that integrates both quantitative and qualitative assessment enables investors to gain a complete view of the stock, ultimately assisting them in carrying out prudent investment choices. Engaging with equity analysis professionals can significantly enhance this process, as they bring knowledge and proficiency to the discussion, ensuring that all relevant data is considered.

Key Indicators and Approaches

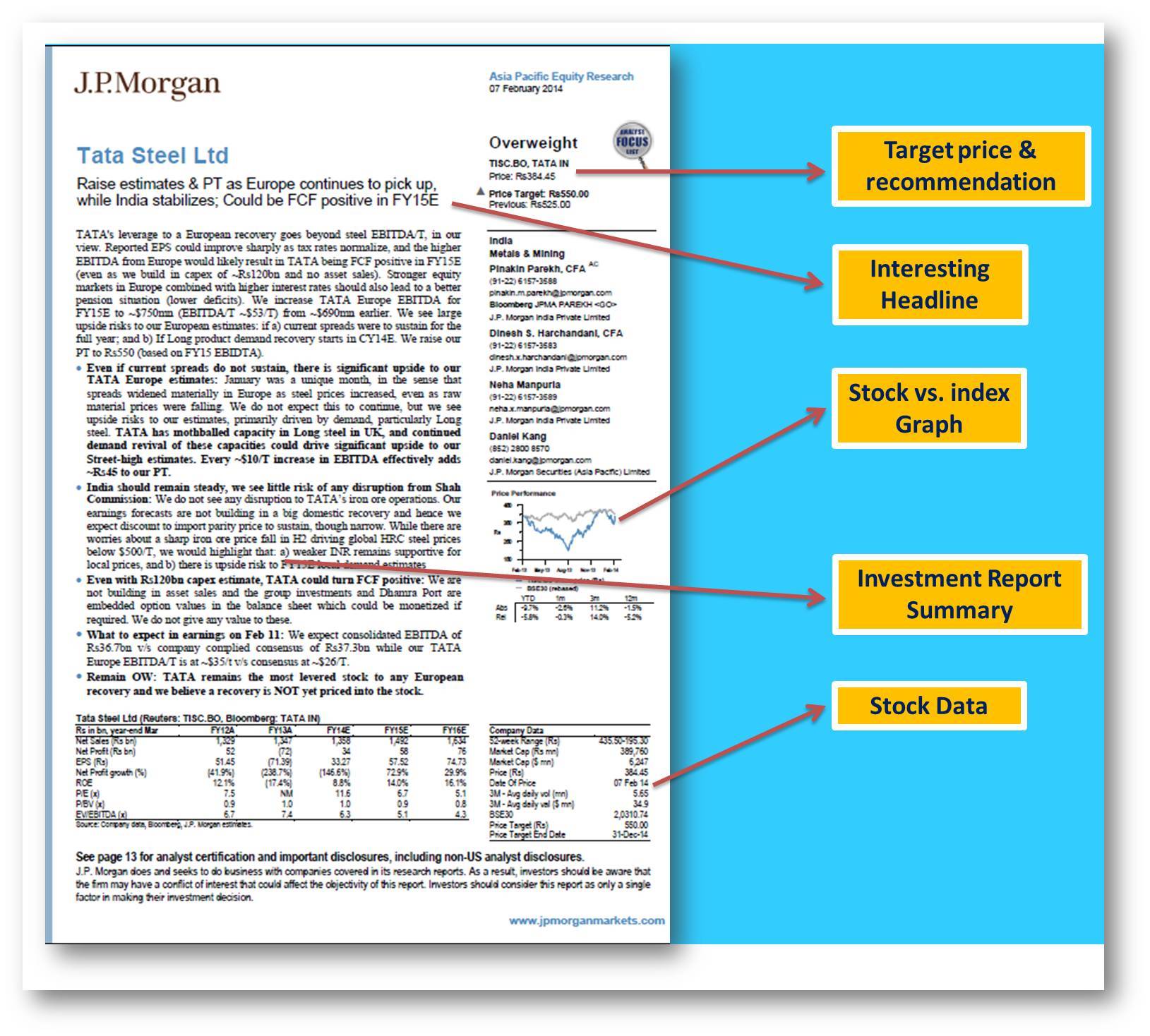

In stock analysis, investors rely on important metrics to evaluate the financial condition and market opportunity of a company. A widely used indicator is Earnings Per Share, which indicates a company's profitability on a share basis. equity research report implies a successful company that may yield substantial returns for investors. Another important indicator is the P/E ratio, which measures the company’s existing share price to its EPS. A decreased P/E ratio might imply that a stock is underpriced, while a high P/E could indicate an overpriced stock or investor expectations of upcoming growth.

Analysts also scrutinize financial measures to gain insights into liquidity, profitability, and leverage. The Liquidity Ratio calculates a company's ability to fulfill immediate obligations, while the Debt-to-Equity ratio analyzes financial risk by juxtaposing total liabilities to shareholder equity. These measures provide a holistic view of the company's business efficiency and risk profile, aiding investors in making informed decisions. Comprehending these measures allows investors to contrast companies across sectors and pinpoint potential investment opportunities.

Equity analysis methods differ, but two widely used strategies are fundamental evaluation and technical evaluation. Fundamental evaluation entails examining financial reports, market standing, and industry trends to assess a company's true value. In opposition, technical evaluation focuses on past price movements and trading volumes to find patterns and make projections about future price actions. By applying these techniques, investors can craft tactics that meet their investment goals, ultimately giving them to capitalize on chances in the stock markets.

Utilization in Capital Approaches

Stock analysis functions as a foundational element for constructing successful investment plans. By methodically assessing a firm's financial health, growth potential, and competitive standing, investors can form a detailed understanding of how to distribute their resources. Incorporating equity analysis allows individuals to discover underpriced stocks that may present significant potential for growth, allowing educated decisions based on data-driven evidence rather than speculation. This calculated approach often results in better risk-adjusted returns over time.

Additionally, equity analysis facilitates the assessment of broader market movements and sector performance. Investors specializing in equity analysis can leverage their insights to reallocate their investment portfolios according to economic conditions, enhancing general investment results. Grasping sector trends, regulatory shifts, and macroeconomic indicators allows for prompt adjustment and positioning, which can be critical in unstable environments. This adaptability builds robustness into investment approaches.

Furthermore, partnership with equity analysis experts can offer a competitive edge. Through partnership with experienced analysts, investors gain access to sophisticated models and methodologies that may enhance their understanding of complex market factors. This cooperation can lead to the creation of unique investment theses and varied portfolios aligned with individual risk profiles and return goals. Engaging with equity analysis professionals fosters informed decision-making that aligns with sustained financial goals.